The financial world is currently going through a big change – not only the complex and invisible system behind it, but especially all offered services for customers. Many buzzwords are trending: blockchain, mobile and streamlined payments as well as p2p transfers, to name only a few. Accompanying these improvements and rising technologies, banks have to deal with other challenges, for example: lack of transparency, privacy issues, trustful relationships, bad user experiences and so on.

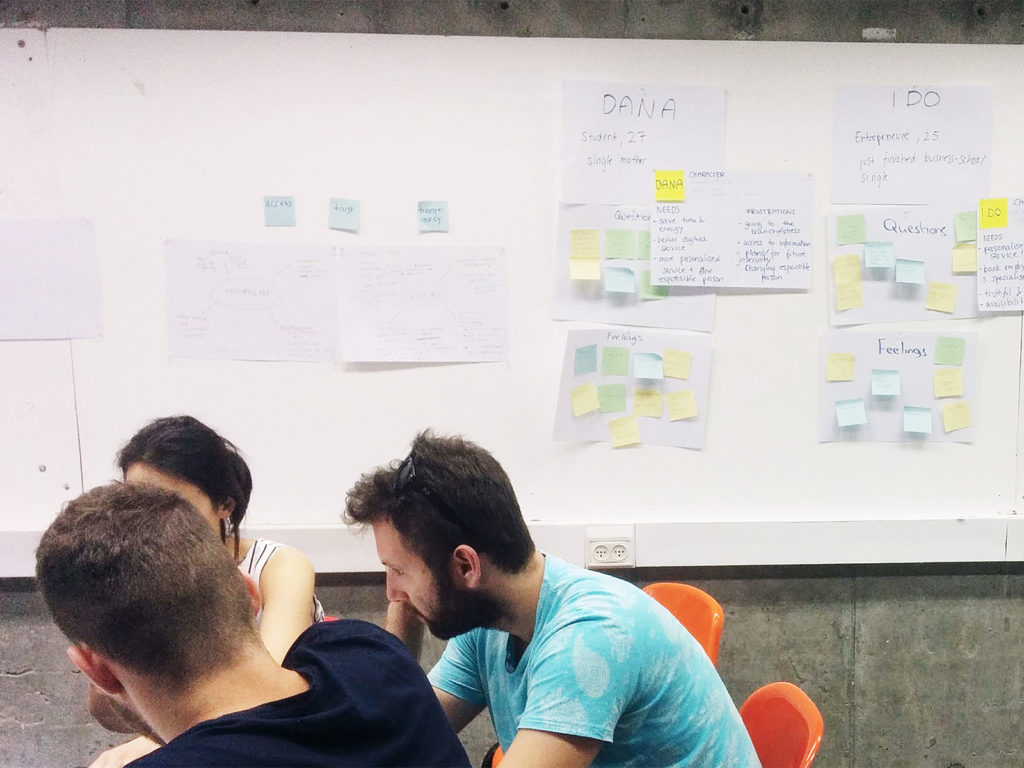

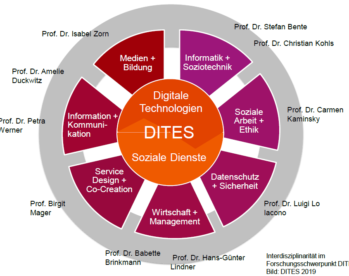

KISD was invited to Shenkar College of Engineering and Design in Ramat Gan to take part in a collaboration with Israel‘s biggest bank Hapoalim. The project was supervised by Prof. Birgit Mager and Prof. Idan Segev and was initiated to find new ways for making banking more attractive to the generation Y by using service design as a core tool. 16 students from Shenkar and six students from Cologne explored crucial pain and gain points and created first concepts and prototypes of digital services. They will support Hapoalim to regain trust from its customers by meeting the visual language and wants especially of the millennials.

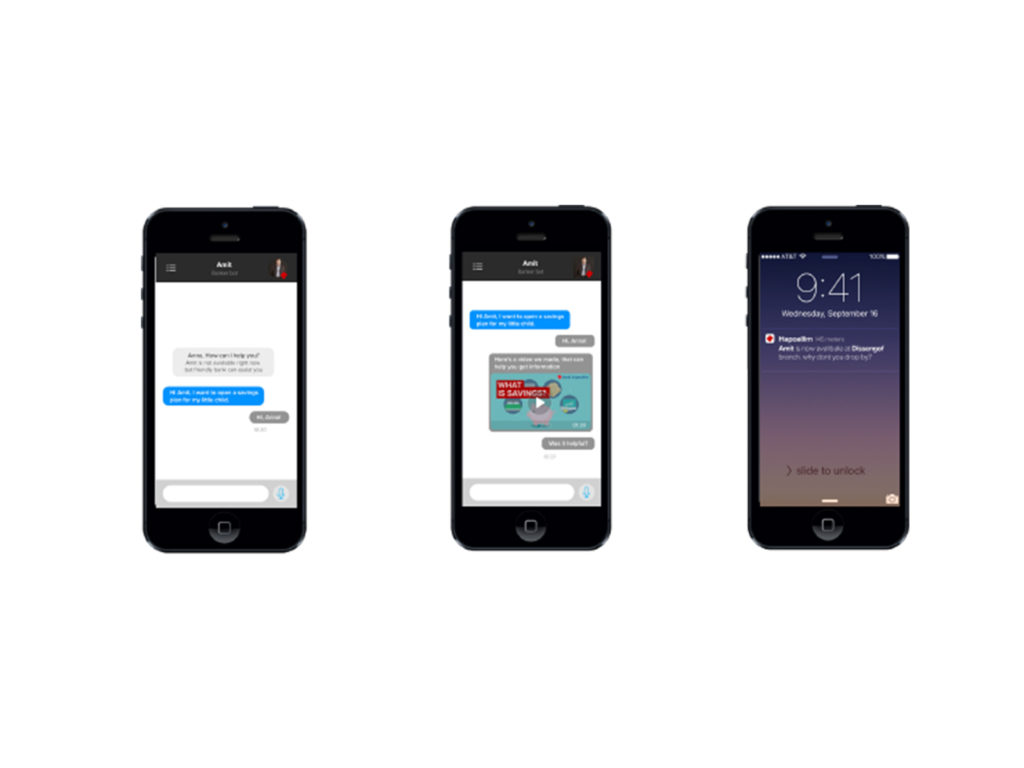

AMIT means friend in Hebrew and that is what this service is offering: a friendly and supporting consulter – when there is a need for it. The product is the connection between the analog and digital service of Hapoalim bank. Through a chat platform – seamlessly integrated into the banking app – the customer can ask questions and gets first information in form of articles, text, and videos. AMIT creates a conversational experience and Haopalim Bank builds a relationship with its customers.

HELP US – HELP YOU is a web platform where the young Hapoalim customers can express themselves and share their ideas for a better banking experience and relationship. The concept faces the two major pain points Israelis have with their bank: lack of trust and transparency.

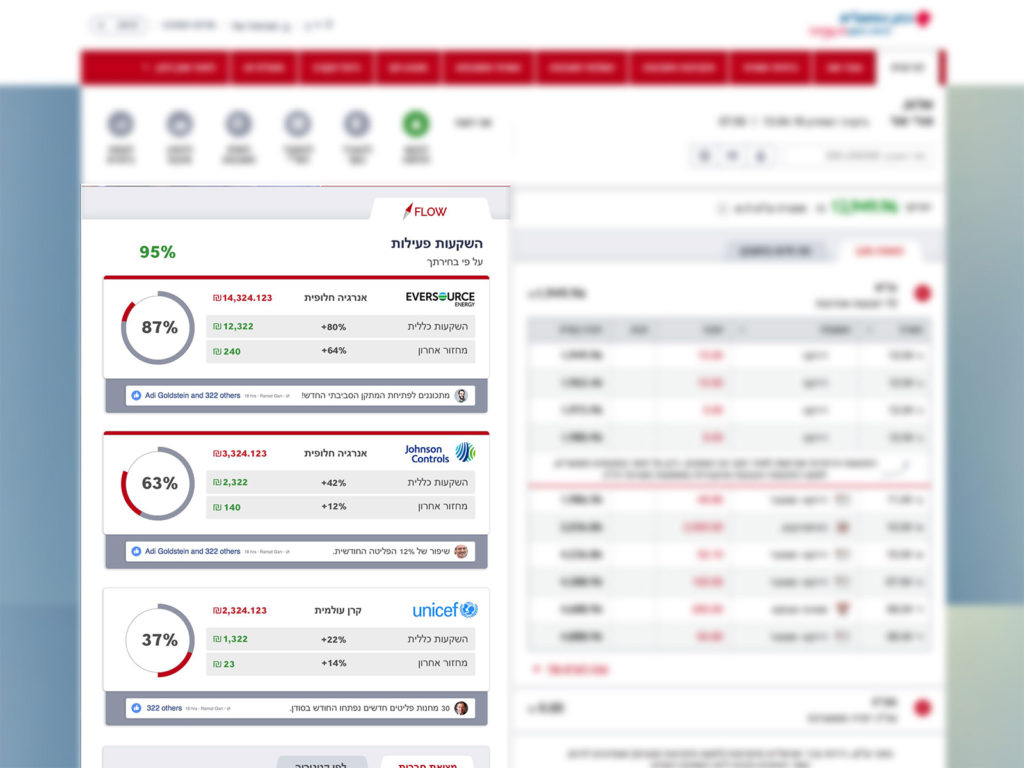

Flow is a smart feature, located in the online banking interface of Hapoalim. It gives customers the opportunity to influence the bank’s agenda by deciding in what Hapoalim can invest their deposits and savings in. They can choose from a wide variety of plans and follow each project’s process in individual blogs. As a result, each customer becomes a partner at eye level in a transparent surrounding.

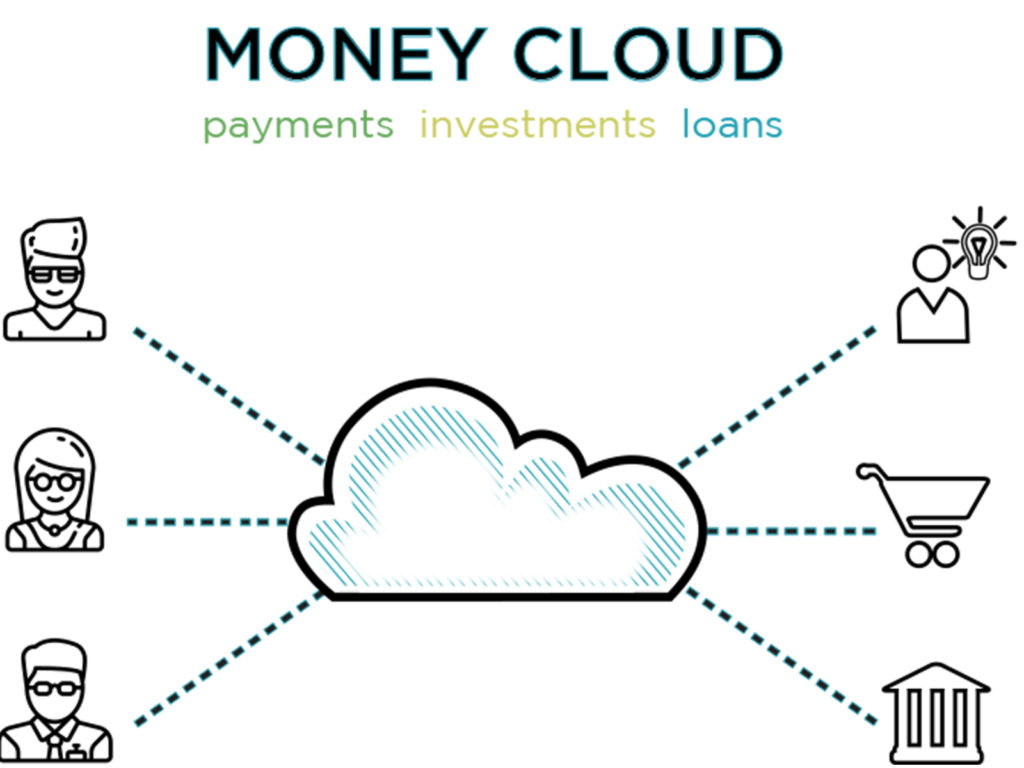

Money Cloud is a new feature proposed to the bank Hapoalim to regain trust of the generation Y and make social banking easier. It is a temporary account for group payments and investments. When all the members transfer their part, the payment is being processed automatically and the account closes. It can also be used to receive group loans from the bank. The main goal was to create a service that corresponds to the needs of the younger generation and thereby showing that the bank cares for the comfort of its clients.